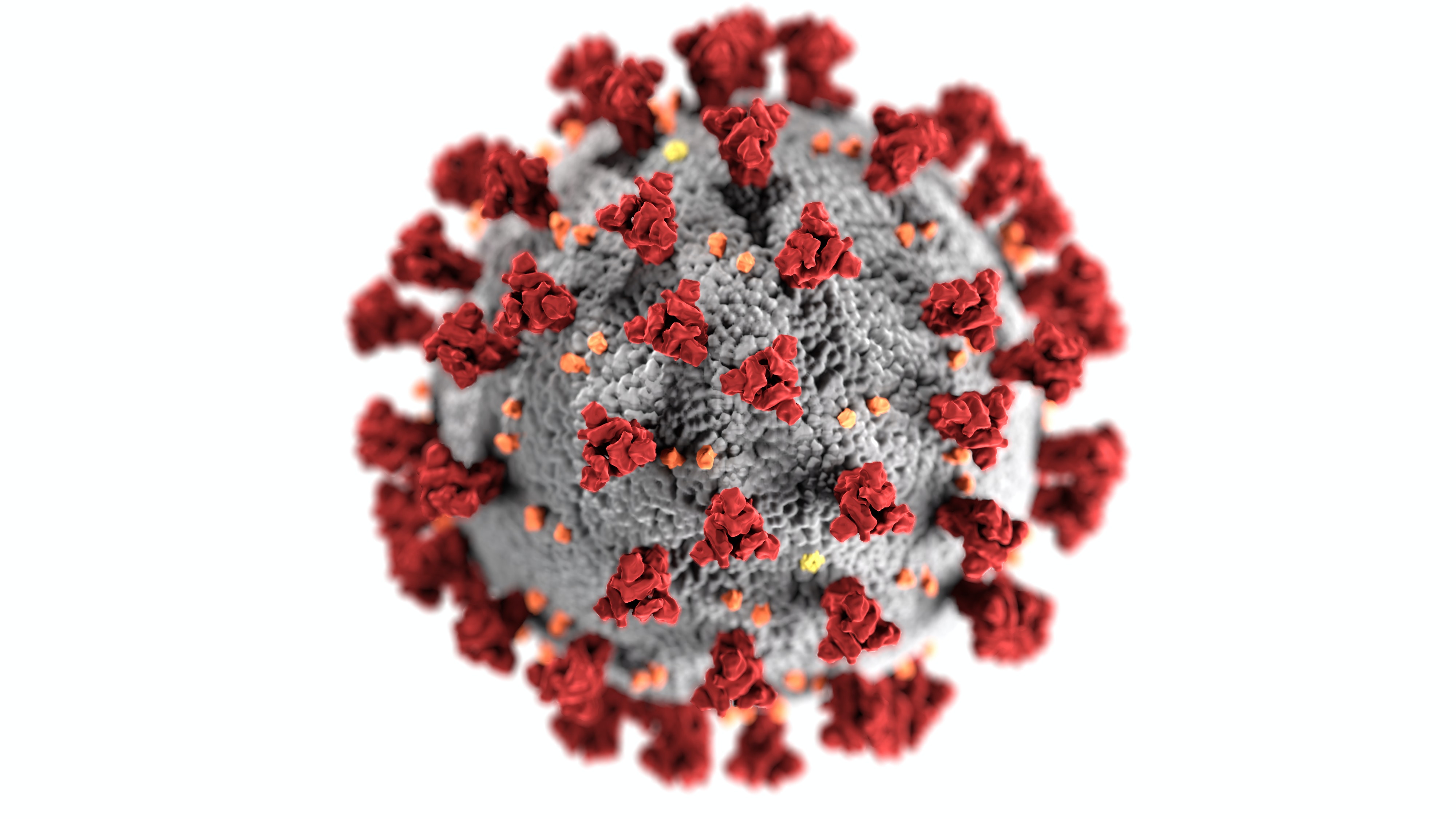

Business Support for Commercial Occupiers & Tenants amid Covid-19

Updated 6th May 2020

Business is facing unprecedented challenges given the Coronavirus pandemic. All commercial occupiers, tenants and landlords are likely to be impacted by Covid-19.

At the time of writing of Prime Minister Boris Johnson announced more stringent limits including; all shops selling non-essential goods to close, public to remain at home except for very limited purposes ( necessary shopping and one form of daily exercise), or travelling to and from work (unless you can work from home).

There are a number of government measures available to UK businesses in the midst of this crisis. Below is a summary of the available support for commercial business occupiers and tenants as of Tuesday 24th March 2020:

Job Retention Scheme

- All UK employers with a PAYE scheme will be able to get support to continue to pay part of employees salary.

- Applies to employees who have been asked to stop working, but remain on the payroll.

- Reimbursement up to 80% of wages and up to £2,500 per month.

- Back dated to 1st March 2020 for at least 3 months (extended if necessary).

- Applies to all UK employers (including the public sector, local authorities and charities) with a PAYE scheme.

- Timing: Grants expected in weeks and full access before the end of April.

VAT and Income Tax Deferral

- Valued Added Tax (VAT) will be deferred for 3 months for all VAT registered businesses.

- No need to apply. Businesses will be given until the end of the 2020-21 tax year to pay.

- Income Tax Deferral will allow the self-employed to defer Income tax due in July 2020 to January 2021.

- No need to apply.

Statutory Sick Pay Relief

- Allow SME’s to reclaim Statutory Sick Pay paid for staff sickness absence due to covid-19.

- Will cover up to 2 weeks Statutory Sick Pay per employee.

- Details of how to access it will be announced shortly.

Business Rates Holiday for Retail, Hospitality and Leisure

- Businesses in the retail, hospitality and leisure sectors in England will not have to pay business rates for the 2020/21 tax year.

- It will apply to shops, restaurants, cafes, drinking establishments, cinemas, live music venues, assembly and leisure uses, hotels, guest and boarding premises and self-catering accommodation

- The business rates holiday will be automatically applied.

Grant funding for retail, hospitality and leisure

- £10,000 grant for those with a rateable value under £15,000

- £25,000 grant for those with a rateablue value between £15,000 and £51,000

- Eligibility if your business is based in England, in the retail, hospitality, and leisure sector.

- Local Authorities will write to eligible businesses with details how to claim the grant. Timing is to be announced asap.

Small business grant funding of £10,000 for business with a small business rate relief

- Support for business paying little or not business rates under small business rate relief, rural rate relief and tapered relief.

- One-off grant of £10,000 to go towards ongoing business costs.

- Eligible businesses include businesses in England, under the relevant reliefs, and a business that physically occupies property.

- Local authorities will write to eligible businesses shortly with details of how to claim this grant shortly.

Coronavirus Business Interruption Loan Scheme to support long-term viable businesses

- Access to loans, overdrafts, invoice finance and asset finance of up to £5 million for up to 6 years.

- Business Interruption Payment to cover the first 12 months of interest payments / lender fees.

- Government will provide a guarantee of 80% on each loan.

- Administered through major commercia and bank lenders, backed by government owned British Business Bank.

- British Business Bank Eligibility criteria and your business must be UK based with a turnover no more than £45 million.

- Businesses can apply by liaising with your bank or applicable finance providers offering the scheme. Full details of the accredited lenders is available on the British Business Bank Website.

- Timing: The scheme is available immediately.

The following institutions web pages could be useful to monitor. They should be upgraded to reflect the changes as they happen.

Nat West

Barclays

https://www.barclays.co.uk/

Lloyds

https://www.lloydsbank.com/

HSBC

https://www.cbil.business.

Santander

Metro Bank

https://www.metrobankonline.

Updated 30th April 2020

A new initiative starting on the 4th May ‘Bounce Back Loans’ will provide a much needed lifeline to business, with the need for limited information requirements and much simpler parameters.

The following gov links provide initial outline of the scheme:

https://www.gov.uk/guidance/

https://www.gov.uk/government/

Covid-19 Corporate Financing Loan Facility

- Bank of England will buy short-term debt from larger companies impacted by short-term funding pressures.

- It will operate for at least 12 months

- Companies that make a ‘material contribution to the UK economy’ are eligible.

- In order to access the scheme, businesses will have to contact their bank directly.

- Timing: The scheme is available immediately.

HMRC Time to Pay Scheme

- All businesses and self-employed people in financial distress with outstanding tax liabilities will receive bespoke arrangements.

- Eligible if your business pays tax to the UK government and you have outstanding tax liabilities.

- Contacting HMRC directly (helpline for advice is 0800 0159 559).

- Support is available immediately.

Business Rates Holidays for Nurseries

- Nurseries in England do not have to pay business rates for the 2020-21 tax year.

- All properties occupied by providers on Ofsted’s Early Years Register and are wholly mainly used for the provision of the Early Years Foundation Stage.

- Local authorities will action this immediately for the 2020-21 tax year.

Landlord’s Forfeiture Rights Suspended

- The Coronavirus Bill will prevent commercial property landlord’s forfeiting and/or opposing business tenancies under the Landlord and Tenant Act 1954.

- Once the Bill has Royal Assent (expected imminently) until 30th June 2020 a commercial landlord will be unable to forfeit a commercial lease for non-payment of rent.

- As well as this a landlord cannot rely on the failure of paying rent as a grounds to oppose a business tenancy under L&T Act 1954.

- Nevertheless given the evolving situation it would be prudent for both landlords and tenants to have immediate dialogue to discuss a suitable solution asap.

The following link covers emergency powers which emphasises the logic for amicable solutions:

Self Employed

On Thursday 26th March the Chancellor announced measures to help the self employed. Main points include:

- Government to provide a taxable grant on 80% of your average trading profit for the last three years profit (three years ended 5th April 2019), up to a maximum £2,500 per month.

- The initial grant will be for the three months, from 1st March until the end of May 2020.

- The grant will be as a lump sum from 1st June 2020.

- In order to qualify for this grant you need to be: A.) Self employed or member / partner of a trading partnership. B.) Have lost trading profits due to the virus. C.) Have filed a tax return for 2018/19 D.) Have traded during the year to 5th April 2020. E.) You must be trading when you apply and intend to continue to trade in the tax year 2020/21. F.) You must have a trading profit of less than £50,000 and more than half your income comes from self employment.

- HMRC will be contacting firms directly based on historic data.

On 6th May 2020 the government announced further support for the Self Employed.

HMRC have stated that they will start contacting people who they believe are eligible and provide a date when applications will commence.

Do you need to close your business?

The government announced further guidance on 25 March 2020 to add onto the guidance released on 23rd March. The details state the following:

- all non-essential retail stores – this will include clothing and electronics stores; hair, beauty and nail salons; and outdoor and indoor markets, excluding food markets;

- libraries, community centres, and youth centres;

- indoor and outdoor leisure facilities such as bowling alleys, arcades and soft play facilities;

- communal places within parks, such as playgrounds, sports courts and outdoor gyms;

- places of worship, except for funerals attended by immediate families; and

- hotels, hostels, bed and breakfasts, campsites, caravan parks, and boarding houses for commercial/leisure use (excluding permanent residents and key workers).

If your business is on this list of businesses and other venues that must close then you are required to close. However, if you are not on the list or within an exception you may stay open, subject to observing the other rules. The reference to closing ‘non-essential business’ has been removed.

We understand tradesmans, construction sites and food delivery will also be allowed to stay open. By that logic suppliers of such businesses will also be allowed to stay open, but it’s not completely clear given the guidance. Clearly the main message is stay at home and work from home if you can do!

Sources:

- Job Retention Scheme – https://www.businesssupport.gov.uk/coronavirus-job-retention-scheme/

- VAT Deferral here: https://www.businesssupport.gov.uk/vat-deferral/

- Income Tax Deferral here: https://www.businesssupport.gov.uk/income-tax-deferral-for-the-self-employed/

- Statutory Sick Pay Relief here: https://www.businesssupport.gov.uk/statutory-sick-pay-rebate/

- Business Rates Holiday for Retail, Hospitality and Leisure here: https://www.businesssupport.gov.uk/business-rates-holiday-for-retail-hospitality-and-leisure/

- Grant Funding for Retail, Hospitality and Leisure here: https://www.businesssupport.gov.uk/cash-grant-for-retail-hospitality-and-leisure/

- Small Business Grant Funding here: https://www.businesssupport.gov.uk/small-business-grant-funding/

- Coronavirus Business Interruption Loan Scheme: https://www.businesssupport.gov.uk/coronavirus-business-interruption-loan-scheme/

- Covid-19 Corporate Financing Facility here: https://www.businesssupport.gov.uk/covid-19-corporate-financing-facility/

- Time to Pay Scheme: https://www.businesssupport.gov.uk/time-to-pay/

- Business Rates Holidays for Nurseries here: https://www.businesssupport.gov.uk/business-rates-holiday-for-nurseries/

If you’re a tenant, landlord or commercial property occupier and need to discuss any related property issue at this difficult time please feel free to call 0114 281 2813 or email us today on info@smcommercial.co.uk

Back to news

Enquire today

Get in touch for more information about any of our services or help finding your perfect property

Property searchContact us